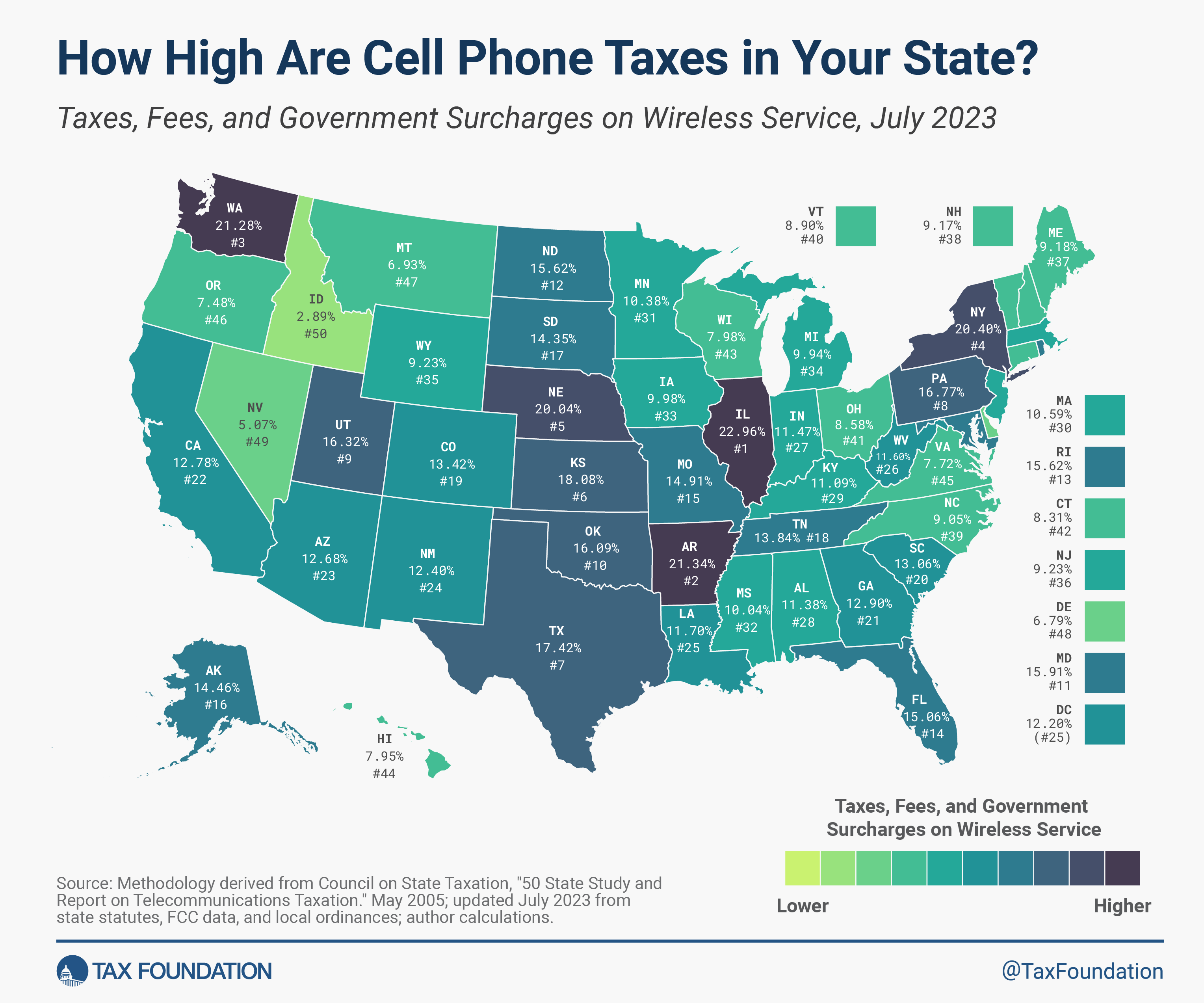

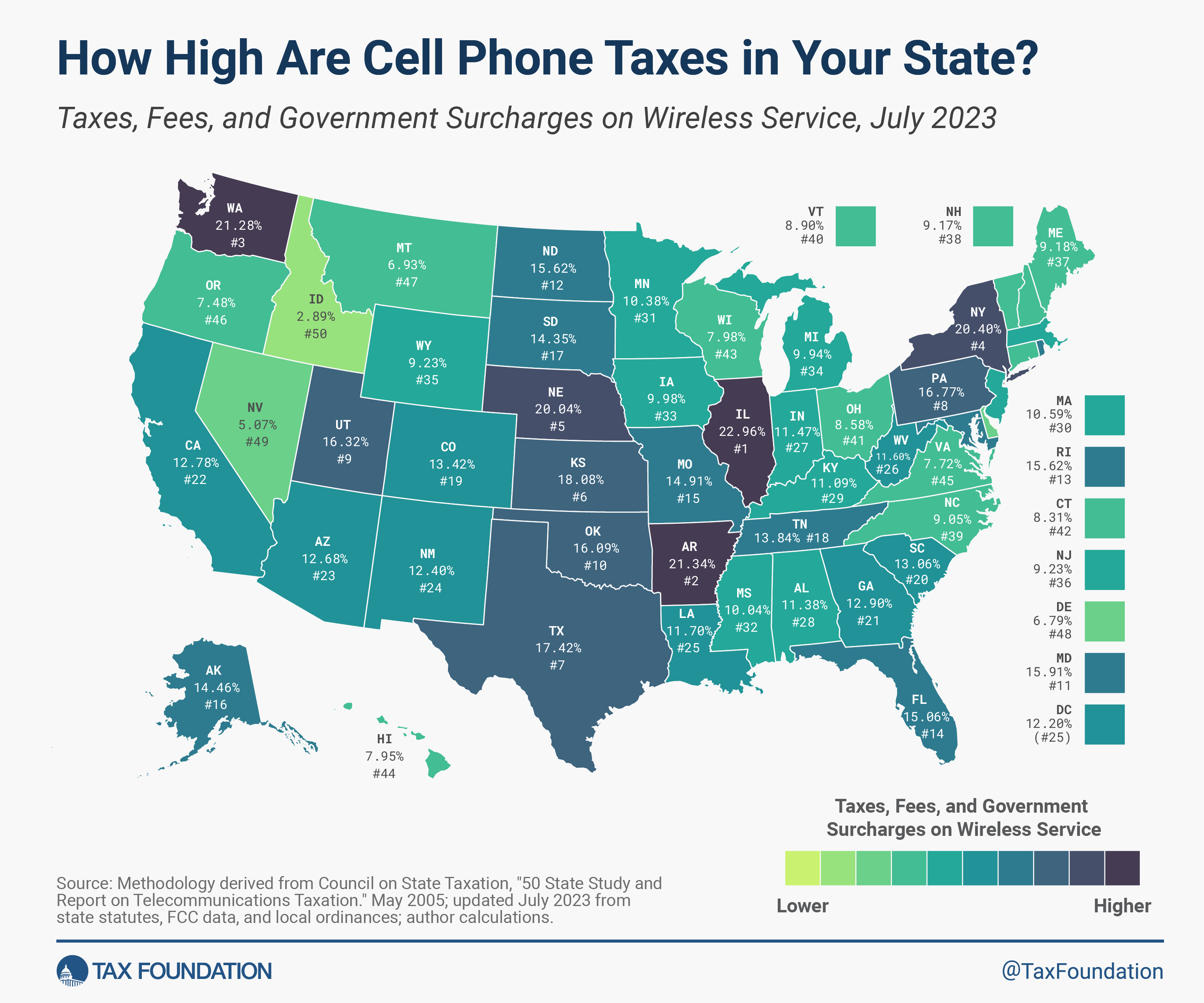

Cell Phone Taxes By State 2024 – A state appeals court ruled that Californians who buy their cellphones at a discount by agreeing to use the dealer’s services must pay sales tax on the full, non-discounted price. The decision, which . If you’re self-employed and you use your cellphone for business, you can claim the business use of your phone business tax experts who are up to date with the latest federal, state and local .

Cell Phone Taxes By State 2024

Source : www.thegeorgiavirtue.comPa. House passes bill eliminating taxes on cell phone service

Source : www.pennlive.comTax Foundation on X: “A typical American household with four

Source : twitter.comState Tax Maps Archives | Tax Foundation

Source : taxfoundation.orgTax Foundation on X: “A typical American household with four

Source : twitter.comI.R.S. to Begin Trial of Its Own Free Tax Filing System The New

Source : www.nytimes.comNews Flash • 2024 Severe Weather Preparedness Sales Tax Holi

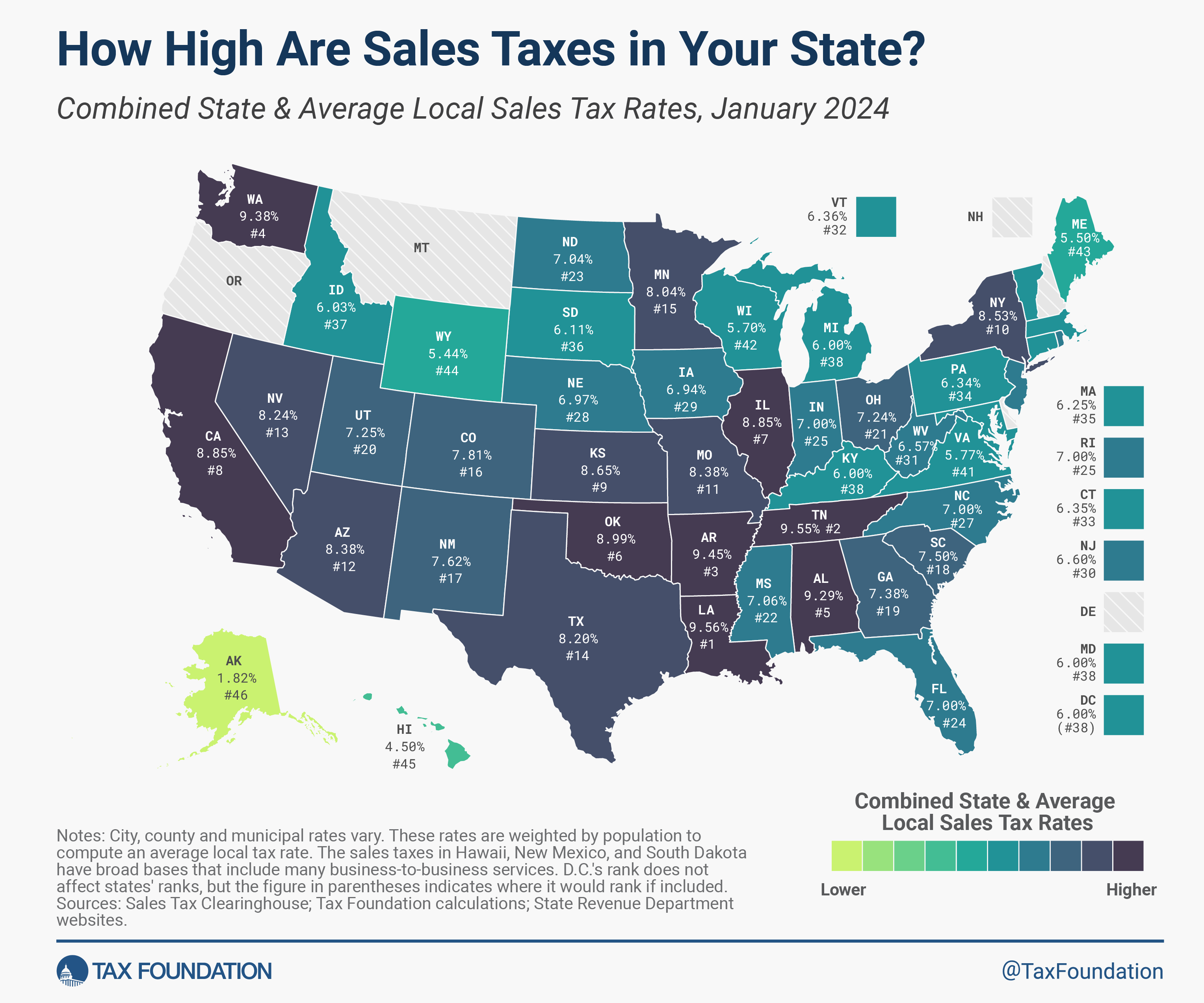

Source : www.orangebeachal.gov2024 Sales Tax Rates: State & Local Sales Tax by State

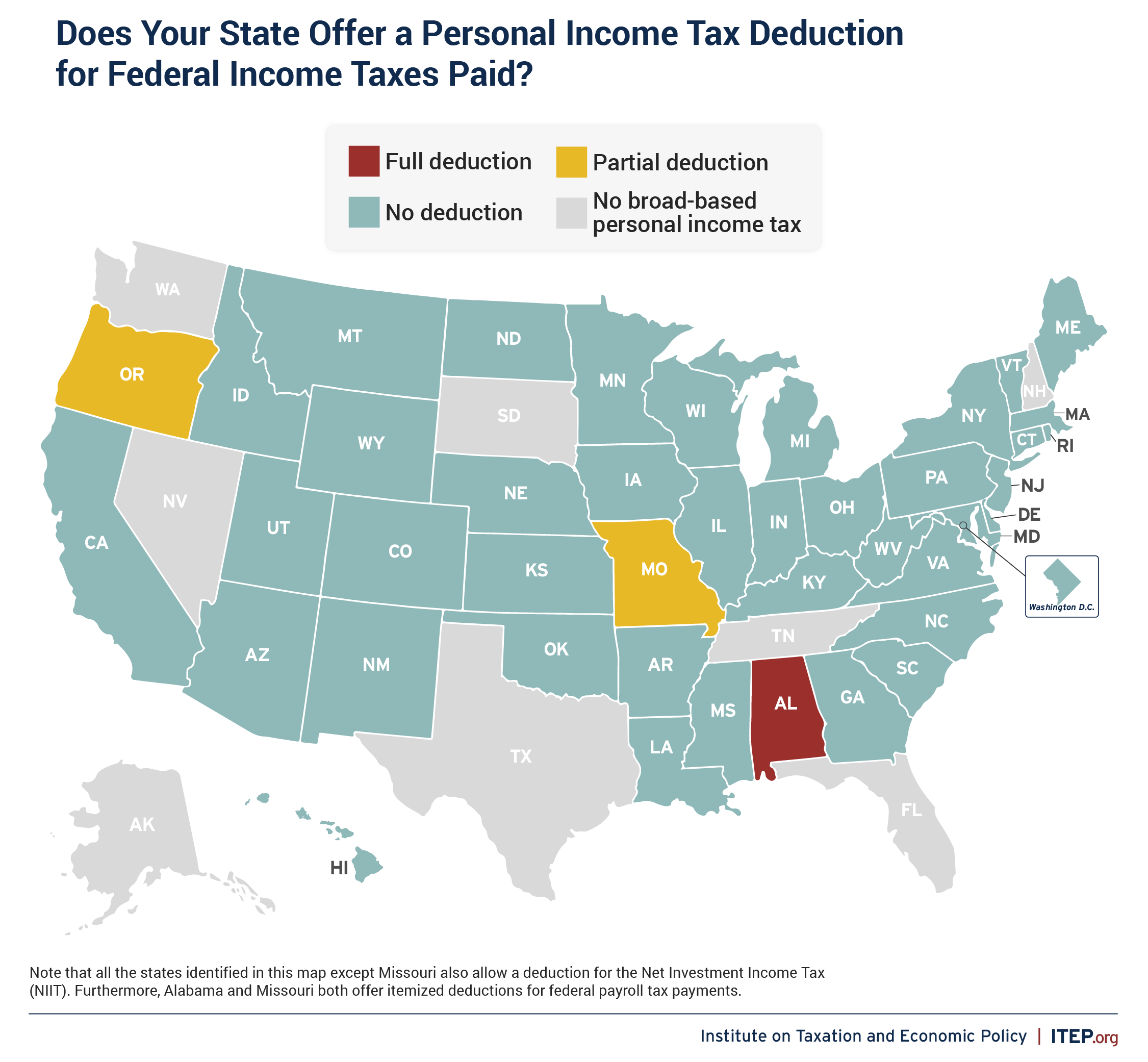

Source : taxfoundation.orgWhich States Allow Deductions for Federal Income Taxes Paid? – ITEP

Source : itep.orgHunter Biden pleads not guilty on federal tax charges

Source : www.axios.comCell Phone Taxes By State 2024 Americans pay hundreds of dollars in wireless phone taxes, report : A low-tax group is concerned Texas may be losing common carriers and can be regulated like internet providers and cell phone companies. An industry group, NetChoice, argued the state was . It’s no surprise Texans, like the rest of the world, have become reliant on consistent cell phone service. So, when a nationwide outage plagued many of the largest cities in the Lone Star State .

]]>