2024 Schedule D 2024 Capital Gains Tax Rates – Capital gains are the profit you make when you sell a capital asset (such as real estate, furniture, precious metals, vehicles, collectibles or major equipment) for more money than it cost you. The . The Schedule D form these gains are taxed at a lower rate than short-term gains. The precise rate depends on the tax bracket you’re in. Any year that you have to report a capital asset .

2024 Schedule D 2024 Capital Gains Tax Rates

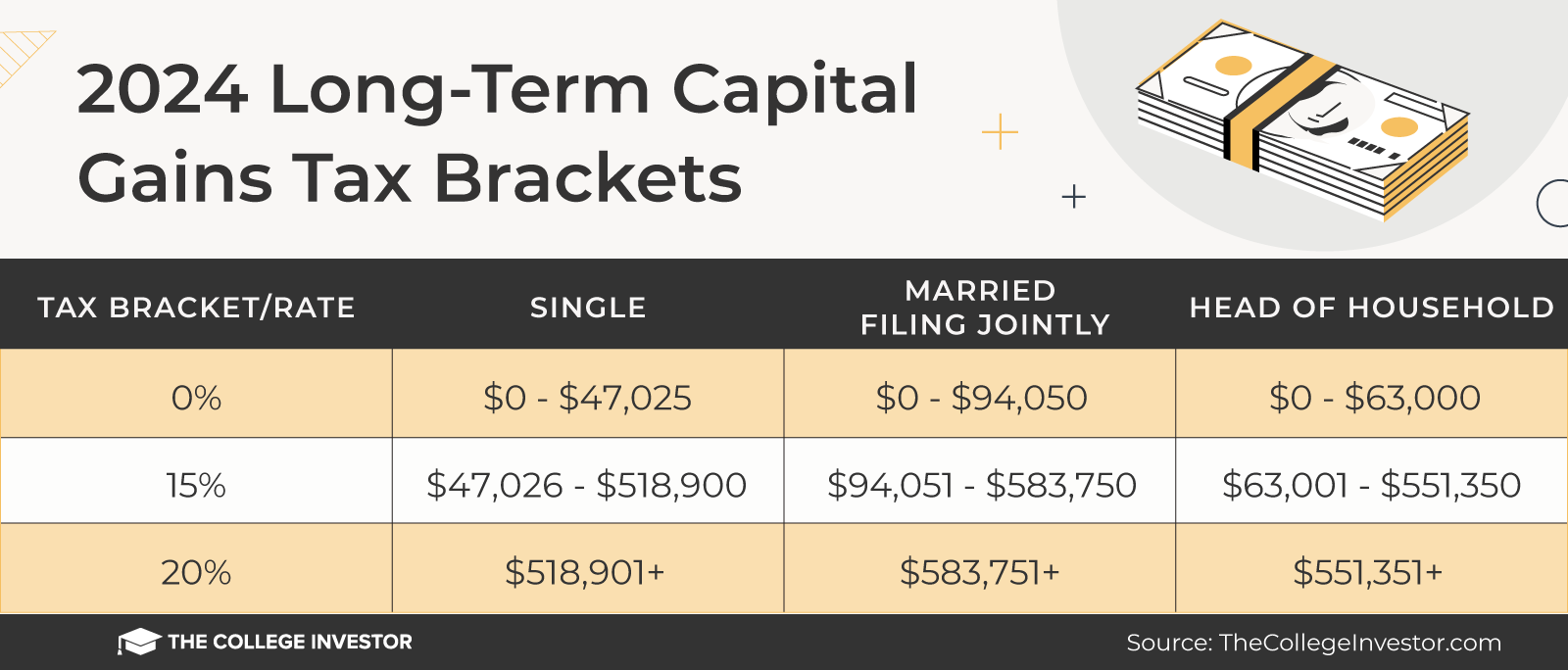

Source : thecollegeinvestor.comHow much you can make in 2024 and still pay 0% capital gains taxes

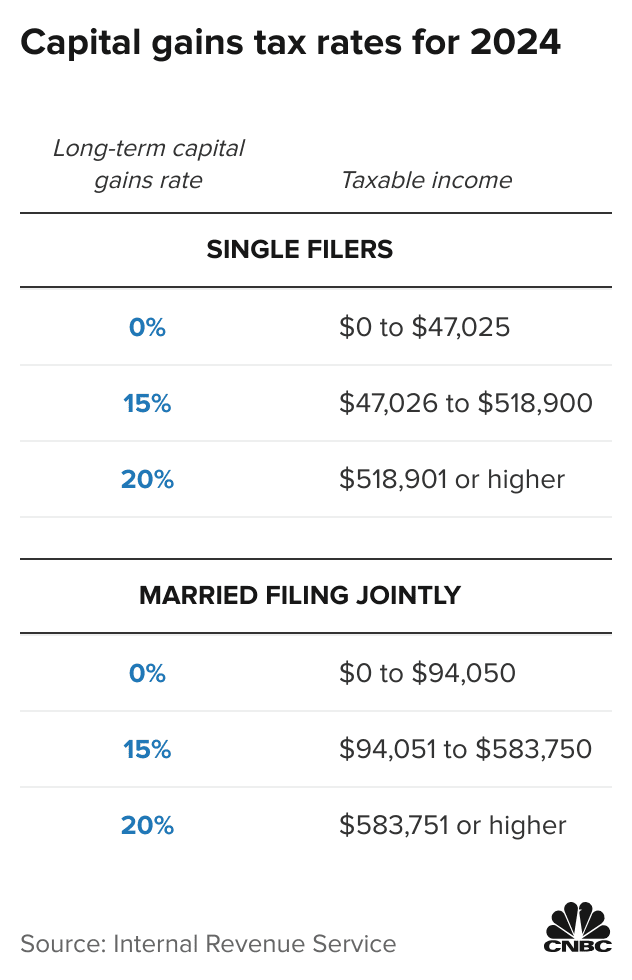

Source : www.cnbc.comCapital Gains Tax Brackets For 2024

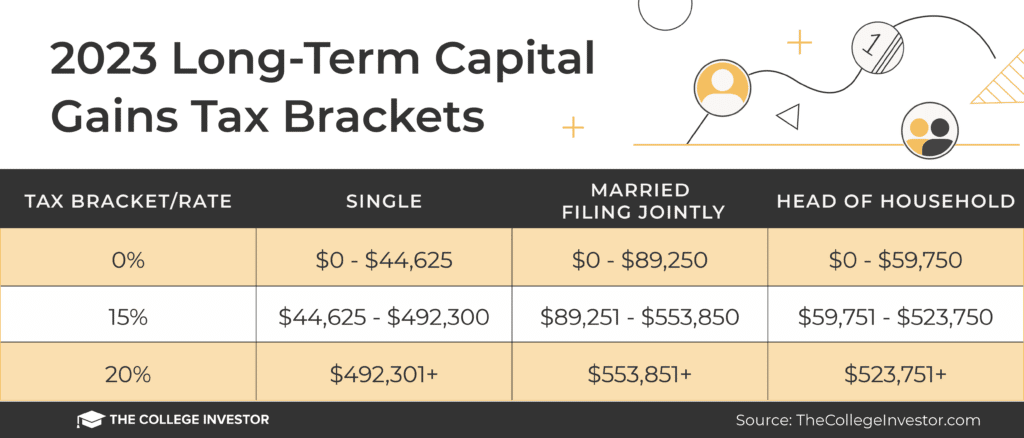

Source : thecollegeinvestor.comCapital Gains Tax Rates For 2023 And 2024 – Forbes Advisor

Source : www.forbes.comCapital Gains Tax Brackets For 2024

Source : thecollegeinvestor.com2024 Capital Gains Tax Rates | SmartAsset

Source : smartasset.comCapital Gains Tax Brackets For 2024

Source : thecollegeinvestor.com2024 State Business Tax Climate Index | Tax Foundation

Source : taxfoundation.orgCapital Gains Tax Brackets For 2024

Source : thecollegeinvestor.comCapital Gains Tax Rates for 2023 vs. 2024 | Kiplinger

Source : www.kiplinger.com2024 Schedule D 2024 Capital Gains Tax Rates Capital Gains Tax Brackets For 2024: See long-term and short-term capital gains tax rates, what triggers capital gains tax, how it’s calculated and ways to save. Many or all of the products featured here are from our partners who . Crypto losses or gains are reported on your personal tax form like any other capital gains tax, including options to offset a tax liability. .

]]>